Truzy-Building Trust in the Age of AI-Powered Reviews

Trust is one of the biggest challenges facing digital commerce. As generative AI accelerates the spread of fake online content, consumer confidence in reviews is under threat. Yet reviews remain critical to decision-making.

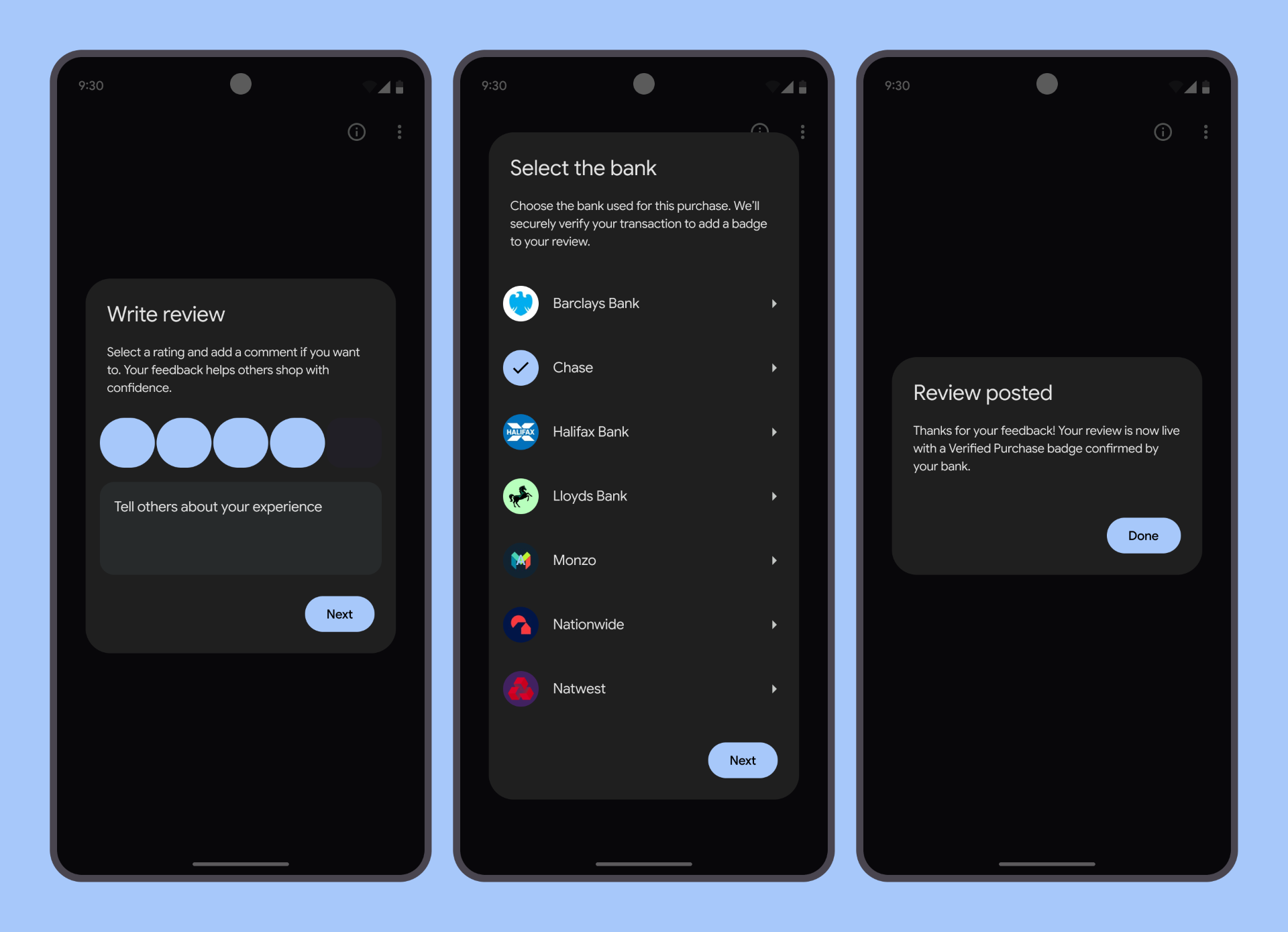

Founded by James Edwards, Truzy is the world’s first open banking–powered review platform, designed to make reviews fun, fair and fake-free — without compromising user privacy.

With support from SuperTech Seeds and SuperTech Collective, Truzy moved from concept to market in under 12 months, validating a complex idea in a regulated environment and launching a live platform with early traction and partner interest.

The Challenge

James entered entrepreneurship with a clear vision but significant barriers:

No prior experience founding a company

No technical background

A highly regulated market with complex compliance requirements

“I had never started a business before. I had no technical background and hadn’t built a product before. Without SuperTech Seeds, I don’t think I would have done it at all.”

The challenge was not just technical feasibility — it was reducing the financial and psychological risk of getting started.

SuperTech’s Role

James joined SuperTech Seeds to test Truzy’s feasibility quickly and safely.

Delivered by SuperTech partner Greater Things, the programme enabled the rapid development of a working MVP in exchange for equity — removing the need for upfront capital and accelerating time to validation. Within weeks, Truzy had a functional prototype proving that verified reviews could be delivered using open banking, marking a critical milestone for investor and partner confidence.

“It made it very low risk. I could find out whether this technically complex idea was viable without gambling everything.”

Iteration Through the SuperTech Collective

Early feedback gathered through the SuperTech Collective revealed a crucial insight: Users wanted transaction verification — but without exposing personal or financial data. Rather than pivot away, Truzy refined its model, developing a privacy-first open banking flow that confirms a real transaction occurred without accessing names, account details or balances.

This process also empowered James to rebuild and iterate the platform himself using no-code tools — rapidly growing his own technical capability as a founder.

“Having other people assess your idea is invaluable. It stops you building in isolation and helps you build the right thing.”

From MVP to Market

Truzy soft-launched its beta platform in December.

With no paid marketing, the platform achieved:

100+ verified reviewed places within two weeks

Rapid user feedback and iteration

Early validation of product-market fit

The beta confirmed that Truzy’s approach delivers a trusted, engaging user experience, even in its early stages.

Ecosystem & Regulatory Support

Beyond programmes, James actively engaged with the wider SuperTech ecosystem through events, roundtables and partnerships.

Truzy also benefited from:

TSB Labs – early industry validation

FCA Regulatory Sandbox – accelerated regulatory insight

ICO Sandbox (upcoming) – recognising Truzy’s privacy-first data approach

This combination positioned Truzy strongly within both innovation and regulatory landscapes.

What’s Next

Truzy is now entering its commercial phase, with a full public launch planned and a clear growth strategy.

Focus areas for 2026 include:

Fundraising

Go-to-market expansion

Continued product refinement

Planned revenue models include:

A freemium review platform with paid business insights

White-label verification services for existing review platforms

Early interest from global commerce and review platforms is already opening scalable partnership opportunities.

Impact of SuperTech Seeds

For James, SuperTech Seeds was the catalyst that transformed an idea into a viable company:

A live platform launched in under 12 months

A non-technical founder became a confident product builder

A world-first concept moved from idea to market

“SuperTech gave me the confidence and capability to start. That changed everything. If you have a complex idea, especially in a regulated market, you need a safe way to test it. SuperTech Seeds gave me that runway.”